Floridians gearing up for the new school year can save money throughout August as the state rolls out its annual Back-to-School Sales Tax Holiday, providing shoppers with tax breaks on essential school-related items.

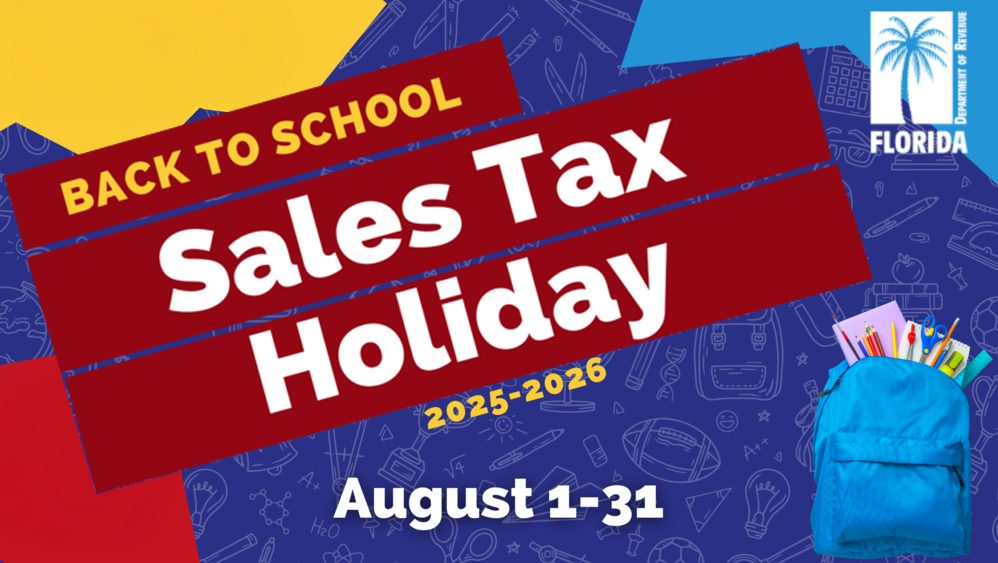

Running from August 1 through August 31, 2025, the tax-free month, officially titled the “Back-to-School Sales Tax Holiday”, allows Floridians to purchase a wide range of educational and personal items without paying state sales tax.

According to the Florida Department of Revenue, the holiday applies to clothing, footwear, and backpacks costing $100 or less per item, as well as school supplies priced at $50 or less. Personal computers and accessories that cost $1,500 or less are also eligible when purchased for non-commercial use.

“This is about helping Florida families stretch their dollars during a time when expenses pile up fast,” said Gov. Ron DeSantis during a press conference earlier this summer. “Whether it’s pencils or laptops, every tax-free purchase makes a difference.”

The tax holiday is part of a larger $1.3 billion tax relief package passed by the Florida Legislature in 2025. The package includes other targeted relief periods such as Disaster Preparedness and Freedom Summer tax holidays, but August’s event remains one of the most widely used by consumers.

Retailers across the state are gearing up for increased traffic, with many offering special promotions to coincide with the tax exemption period. The Florida Retail Federation estimates that the back-to-school holiday will generate a significant boost in consumer activity, particularly as inflation concerns linger for many households.

Floridians are encouraged to consult the Department of Revenue’s official list of qualifying items before shopping. Not all goods are exempt, and certain price limits and use restrictions apply.

For more information and a detailed list of eligible items, visit floridarevenue.com.